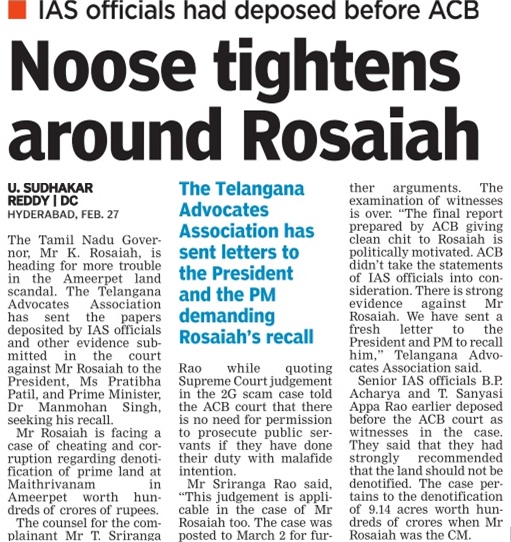

ஹைதராபாத்: ஆந்திராவில் ராஜசேகர ரெட்டி முதல்வராக இருந்தபோது அவரது அமைச்சரவையில் நிதியமைச்சராக இருந்தவர் ரோசய்யா. பின்னர் ராஜசேகர ரெட்டி மரணமடைந்ததைத் தொடர்ந்து தற்காலிக முதல்வராகப் பொறுப்பேற்றார். அதற்கு ஜெகன் மோகன் ரெட்டி கோஷ்டியினர் கடும் எதிர்ப்பு தெரிவித்து தொடர்ந்து குழப்பம் விளைவித்து வந்ததால் ரோசய்யா பதவி விலகினார்.

ஹைதராபாத்: ஆந்திராவில் ராஜசேகர ரெட்டி முதல்வராக இருந்தபோது அவரது அமைச்சரவையில் நிதியமைச்சராக இருந்தவர் ரோசய்யா. பின்னர் ராஜசேகர ரெட்டி மரணமடைந்ததைத் தொடர்ந்து தற்காலிக முதல்வராகப் பொறுப்பேற்றார். அதற்கு ஜெகன் மோகன் ரெட்டி கோஷ்டியினர் கடும் எதிர்ப்பு தெரிவித்து தொடர்ந்து குழப்பம் விளைவித்து வந்ததால் ரோசய்யா பதவி விலகினார்.இந்த நிலையில் இவர் முதல்வராக இருந்தபோது அமீர்பேட் பகுதியில், அரசு நிலத்தை கையகப்படுத்தியது தொடர்பாக சர்ச்சை எழுந்தது. அரசால் கையகப்படுத்தப்பட்ட நிலத்தை மீண்டும் அதன் உரிமையாளருக்கே திருப்பிக் கொடுத்து விட்டனர். இதனால் ரூ. 200 கோடி அளவுக்கு அரசுக்கு இழப்பு ஏற்பட்டதாக சர்ச்சை வெடித்தது. இதையடுத்து ஹைதராபாத்தைச் சேர்ந்த வழக்கறிஞர் ரங்காராவ் என்பவர் வழக்குப் போட்டார்.

இதையடுத்து கோர்ட் உத்தரவுப்படி இந்த வழக்கை லஞ்ச ஒழிப்புப் போலீஸார் விசாரணை நடத்தினர். இந்த வழக்கில் சாட்சியம் அளிக்குமாறு உள்துறை முதன்மைச் செயலாளர் பி.பி. ஆச்சார்யா, தொழில் மற்றும் வர்த்தக துறை முதன்மைச் செயலாளர் சன்யாசி ராவுக்கு ஊழல் தடுப்பு வழக்கு சிறப்பு கோர்ட்டிலிருந்து சம்மன் போனது. இதையடுத்து இருவரும் நேரில் ஆஜராகி சாட்சியம் அளித்தனர்.

அப்போது அவர்கள் கூறுகையில், நிலம் கையகப்படுத்துவது தொடர்பாக முதல்வர் ரோசய்யா நாங்கள் கூறியதை ஏற்கவில்லை. நிலத்தை திருப்பி ஒப்படைக்க கூடாது. இதனால் அரசுக்கு பெரும் பாதிப்பு ஏற்படும். வளர்ச்சி பணிகளுக்கு தடையாக அமைந்தவிடும் என்று சொன்னோம் ஆனால் இதனை அவர் சட்டை செய்யாமல் நிலத்தை உரிமையாளர்ரிடம் கொடுத்து விட்டார் என்றனர். இதைத் தொடர்ந்து வழக்கு பிப்ரவரி 3ம் தேதிக்கு ஒத்திவைக்கப்பட்டது.

இந்த வழக்கில் நேரில் ஆஜராகி சாட்சியம் அளிக்குமாறு ஹைதராபாத் பெருநகர வளர்ச்சி ஆணைய மூத்த அதிகாரி நாராயண ரெட்டிக்கும் சம்மன் அனுப்பப்பட்டிருந்தது. ஆனால் அவர் ஆஜராகவில்லை.

ஹைதராபாத்தின் மையப் பகுதிதான் இந்த அமீர்பேட். இங்கு வணிக வளாகம், நகர்ப்புற வளர்ச்சித் திட்டங்களை அமல்படுத்துவதற்காக மாநில அரசு 9 ஏக்கர் நிலத்தை கையகப்படுத்தியது. ஆனால் அதற்கான நடவடிக்கைகள் தொடங்குவதற்கு முன்பாகவே, ஜி.என்.நாயுடு என்பவர், கடந்த 1997ம் ஆண்டு அந்த நிலத்தை, நில உரிமையாளர்களிடமிருந்து வாங்கி விட்டார்.

இதையடுத்து கையகப்படுத்திய நிலத்தை மீண்டும் உரிமையாளரிடமே கொடுத்து விட்டது ஆந்திர அரசு. இதில்தான் சர்ச்சை வெடித்தது.

இந்த வழக்கு தற்போது சூடு பிடித்திருப்பதால் ரோசய்யாவுக்கு சிக்கல் உருவாகும் என்று தெரிகிறது.

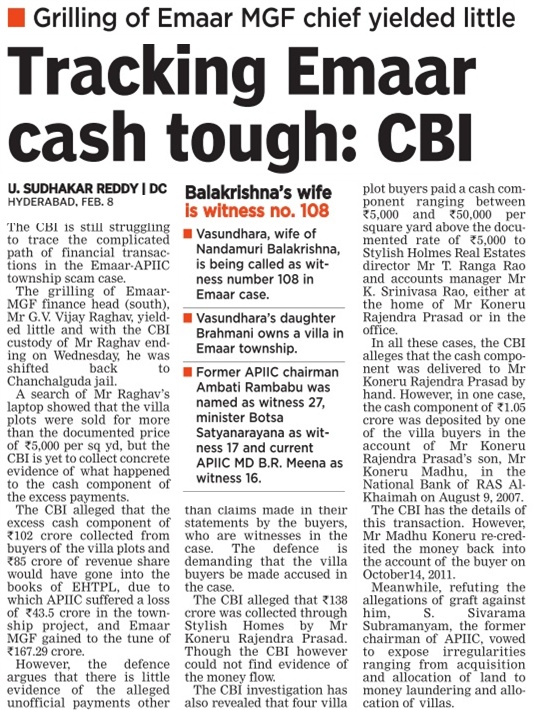

ஆந்திர மாநில முன்னாள் முதல்-மந்திரி மறைந்த ராஜ சேகர ரெட்டியின் மகன் ஜெகன்மோகன் ரெட்டி. இவர் ஒய்.எஸ்.ஆர். காங்கிரஸ் என்ற கட்சியை தொடங்கி நடத்தி வருகிறார். காங்கிரஸ் கட்சியை விட்டு விலகியதும் இவருக்கு எதிராக சொத்துகுவிப்பு புகார் கூறப்பட்டது. இவ்வழக்கை சி.பி.ஐ. விசாரித்து வருகிறது.

ஆந்திர மாநில முன்னாள் முதல்-மந்திரி மறைந்த ராஜ சேகர ரெட்டியின் மகன் ஜெகன்மோகன் ரெட்டி. இவர் ஒய்.எஸ்.ஆர். காங்கிரஸ் என்ற கட்சியை தொடங்கி நடத்தி வருகிறார். காங்கிரஸ் கட்சியை விட்டு விலகியதும் இவருக்கு எதிராக சொத்துகுவிப்பு புகார் கூறப்பட்டது. இவ்வழக்கை சி.பி.ஐ. விசாரித்து வருகிறது.