ஸ்பெக்ட்ரம் ஒதுக்கீடு விவகாரத்தி்ல் ஏற்பட்ட இழப்பீட்டை கூடுதலானது இழப்பு என்பதால் பரபரப்பினை ஏற்படுத்தியுள்ளது.

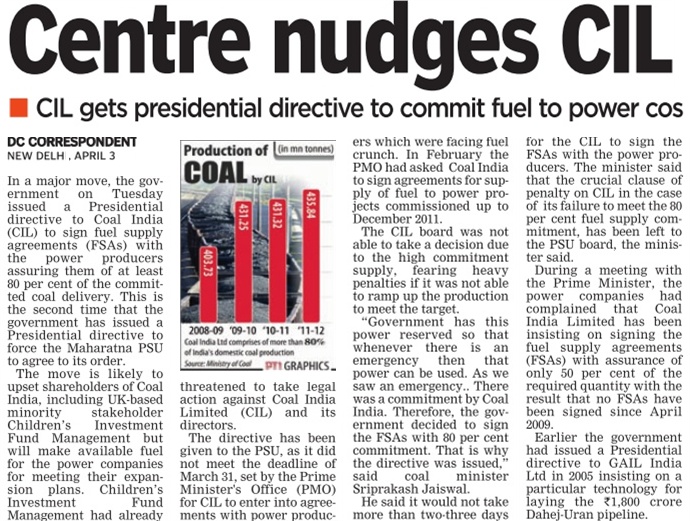

மின்சார உற்பத்திக்காக அனல்மின்நிலையங்களுக்கு தேவையான நிலக்கரி வர்த்தக ரீதியாக , அரசிற்கு சொந்தமான சுரங்கங்கங்களிலிருந்து ஏலம் விடப்படுகிறது. இவ்வாறு ஏலம்விடப்படாமல் கடந்த 2004-ம் ஆண்டு முதல் 2009-ம் ஆண்டு வரையிலான காலத்தி்ல் அரசுக்கு ரூ. 10.7 லட்சம் கோடி இழப்பீடு ஏற்பட்டதாக மத்திய தணிக்கை ஜெனரல் (சி.ஏ.ஜி) கூறியுள்ளது. இது தொடர்பாக சி.ஏ.ஜி. வெளியிட்டுள்ள 110 அறிக்கையில், கூறப்பட்டுள்ளதாவது:

நாடு முழுவதும் அரசிற்கு சொந்தமான 155 நிலக்கரி சுரங்கங்கங்களிலிருந்து நிலக்கரி வெட்டி எடுக்கப்பட்டு , அனல்மின்நிலையங்களுக்கு மின் உற்பத்தி மற்றும் சிமெண்ட் உற்பத்திக்காக வர்த்தகரீதியில் ஏலம் வாயிலாக விற்கப்படுகிறது. இதில் தனியாருக்கு ஏலம் விடப்படாமல் ரூ.4.76 லட்ம் கோடியும், அரசு பயன்பாட்டிற்கு ஏலம்விடாமல் ரூ. 5.88 லட்சம் கோடி என ரூ.10.7 கோடி வருவாய் இழப்பீடு ஏற்பட்டுள்ளது. இந்த வருவாய் கடந்த 2004-ம் ஆண்டு முதல் 2011--ம் ஆண்டு மார்ச் 31-ம் தேதி வரை கணக்கிடப்பட்டுள்ளது என்று அந்த அறிக்கையில் கூறப்பட்டுள்ளது.