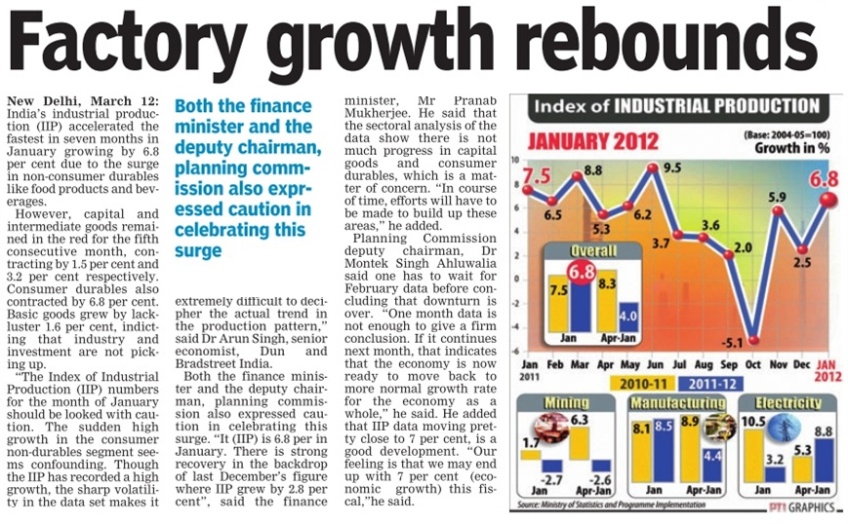

ஆசியா மற்றும் சர்வதேச அளவில் வளர்ந்து வரும் நாடுகளின் பொருளாதார எதிர்காலம் பற்றிய இந்த அறிக்கையில், வட அமெரிக்கா மற்றும் மேற்கு ஐரோப்பியநாடுகளின் பொருளாதார நிலையானது 2050-ல் கடும் சரிவை சந்திக்கும் என்று சுட்டிக்காட்டப்பட்டுள்ளது.

2010-ல் 41 சதவீதமாக இருக்கும்இந்த நாடுகளின் பொருளாதார வளர்ச்சியானது 2050-ல் 18சதவீதமாக குறைந்துவிடும் என்கிறது அந்த அறிக்கை.ஆசிய நாடுகள்

வளர்ந்து வரும் ஆசிய நாடுகளில் சீனாவின் பொருளாதார வளர்ச்சியானது 27சதவீதத்தில் இருந்து 49 சதவீதமாக உயரும்.

உலக அளவில் பொருளாதார வளர்ச்சியில் தற்போது முதலிடத்தில் இருக்கும் அமெரிக்காவை 2020-ம் ஆண்டு சீனா முந்திவிடும். 2050-ல் சீனாவை இந்தியா முந்திவிடும் என்கிறது அறிக்கை.

2050ல் இந்தியாவின் மொத்த உள்நாட்டு உற்பத்தித் திறனானது 85 டிரில்லியன் டாலராக இருக்கும் என்றும் கணிக்கப்பட்டுள்ளது.

இத்தகைய கணிப்புகளானது எதிர்காலத்தில் சர்வதேச அளவில் ஆசிய நாடுகளின் முக்கியத்துவத்தையே வெளிப்படுத்துகின்றன என்கின்றனர் பொருளாதார

வல்லுநர்கள்.

இதேபோல் வட அமெரிக்கா மற்றும் மேற்கு ஐரோப்பிய நாடுகளை ஒப்பிடுகையில் பணக்காரர்கள் அதிகமாக இருப்பது தென்கிழக்கு ஆசியா, சீனா, ஜப்பான் நாடுகளில்தான் என்கிறது அறிக்கையின் புள்ளிவிவரம்!